Putting Hemp on Ice: The Fight Over America’s Next Social Drink

A new generation is choosing a lighter lift without the hangover. The alcohol lobby wants time to catch up.

Walk through a grocery store or a liquor aisle right now and you notice something small that says something big. Next to your go-to hazy IPA and the mass-produced and well-marketed Cab Sauv are slim cans with clean labels promising calm or balance. Shelves that once belonged entirely to alcohol now read like a referendum on how people want to feel, gather, and wake up the next morning. The change looks subtle. The numbers, though? Undeniable.

Alcohol use sits at the lowest level Gallup has ever recorded since it began measuring American habits 90 years ago. Barely half of American adults drink at all. Among Gen Z, half of adults over 21 have never had a drink. Half. The average weekly drink count has fallen from five to under three in two decades.

People are still gathering. They are still hanging out, cooking out, and otherwise socializing together. The rituals remain. The hangover just does not feel like a fair price of admission anymore. This generation came of age with more information, more language for wellness, and clearer expectations for how they want to feel in the morning. That shift carries consequences for an industry that long assumed its place in American life was unshakable.

And the alternative sits right there in the cooler.

A Door Opened by Chemistry, Culture, and Timing

“For a century, alcohol assumed it would always be first to the party and last to leave. Suddenly it shares the room.”

For years, cannabis beverages lived behind dispensary counters under rules designed for flower jars and gummies. Vault storage. Pharmaceutical, child-proof, tamper-proof packaging. A form designed to prove compliance rather than meet consumers where they live.

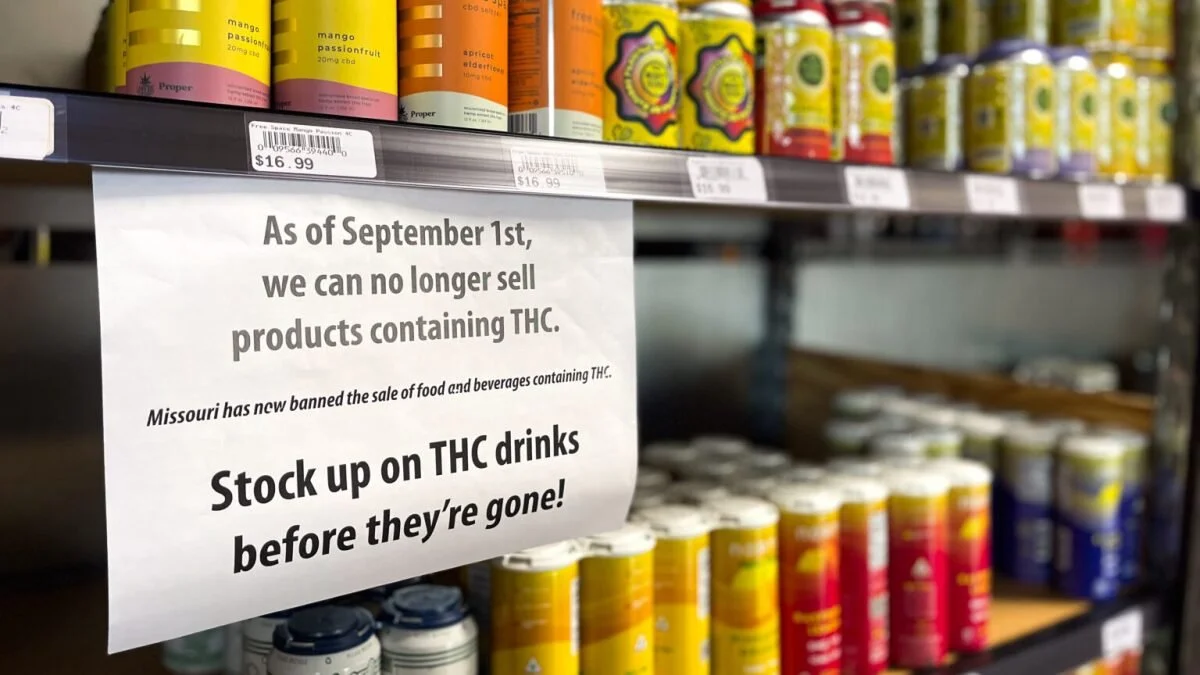

Then hemp-derived THC beverages entered through a different legal doorway. Same molecule. Different path. They moved into convenience stores and liquor stores, priced like any other adult-use drink. They sat beside hard seltzers and non-alcoholic beers, sold to customers over 21 with the same expectation of responsibility that retailers already understand. No stigma. No velvet rope. No whispered explanations.

People tried them, liked the way they felt, and came back for more. They’re still coming back, too.

Sales reached roughly $382 million in 2024 and are on pace for $600 million this year. Combined with dispensary channels, the category already exceeds $1 billion. Billion, with a B. In Minnesota, where lawmakers created a pathway early, THC beverages now account for about 15% of liquor store sales only two years into the program.

For a century, alcohol assumed it would always be first to the party and last to leave. Suddenly it shares the room.

Culture Moved First

In reality, hemp beverages arrived before Congress finished debating vocabulary. They built trust through experience rather than marketing. Now the marketing is taking off, though. They became part of social routines before policy set the table. That sequence matters.

Sometimes culture moves and law follows. When that happens, established institutions feel unprepared. Their authority feels reactive rather than directive, and that discomfort often shows up as a request to slow things down. Or stop altogether.

A regulated adult-use market has taken hold across mainstream retail. The task now is to govern what people are already choosing, not to imagine the clock can be turned back because change makes incumbents uncomfortable.

When Power Asks for Time

“The request to pause the market did not follow public harm or regulatory confusion. It followed adoption that arrived faster than institutions expected, and faster than some legacy businesses were prepared to compete with.”

This week, several major alcohol trade associations asked Congress to pull intoxicating hemp beverages from the market while federal rules are written. The letter came from the Beer Institute, the Distilled Spirits Council of the United States (DISCUS), WineAmerica, the Wine Institute, and the American Distilled Spirits Alliance (ADSA). The language focused on loopholes, safety, and responsible oversight.

In Washington, requests like that usually carry a subtext. Federal standards for THC beverages have been discussed for years without producing a single rule. Promising future guidance has become a way to acknowledge change without committing to it. When an industry asks Congress to pause a market until rules arrive, and the rules remain theoretical, the goal often sounds more like buying time than building policy.

And time matters here. Time to help shape the framework. Time to prepare for entry. Time to make sure a new category does not mature before legacy players have secured their position.

Pay attention to who did not sign that letter. Some trade groups sat out, and labor unions representing key segments of the alcohol workforce stayed off it as well. Many parts of the industry were never part of the conversation to begin with. Independent retailers, craft breweries, small distributors, and neighborhood bars are seeing this shift from the ground up. They serve adults responsibly. They respond to demand at the counter and on Friday nights, not in federal briefings.

The differences inside the alcohol sector mostly come down to scale. Large national players have an incentive to slow the category until they can enter on their terms. Smaller operators live closer to consumer behavior and do not have the luxury of waiting years for federal clarity. A missing signature does not equal opposition, and a signed letter does not equal consensus. This debate centers less on whether THC beverages belong in adult retail and more on who gets to shape the pace and structure of the market ahead.

The timing drives this conversation. THC beverages reached mainstream shelves and everyday adult consumers before federal regulators built a framework for them. The request to pause the market did not follow public harm or regulatory confusion. It followed adoption that arrived faster than institutions expected, and faster than some legacy businesses were prepared to compete with.

The Path Forward Is Not a Pause

The largest alcohol companies have encountered cannabis before. They put real capital behind dispensary-based strategies, built partnerships, and expected early positioning to translate into long-term advantage. The results did not match the projections. Federal reform slowed. State systems proved expensive and uneven. The consumer path developed differently than the slide decks and “expert” forecasts imagined.

Cannabis operators kept experimenting, improving emulsions, refining onset, and treating beverages as a real form factor rather than a novelty. Hemp operators then applied those advances to a channel with faster access to consumers. Regulation did not open the market. Consumers did. That shift arrived sooner than traditional players expected.

We are living that moment in real time. A legacy industry sees change gathering speed and reaches for the same levers it has always used: pause, study, shape, control. Apply influence where it can. Yet consumers have already chosen how and where they want to buy these products, and they are doing so in the same environments where other adult beverages are sold.

The country does need national standards for THC beverages. Clear potency limits. Real testing. Honest labeling. Age controls that work. Enforcement that means something. This industry earns its future by meeting those obligations, not avoiding them. Responsible rules are not a threat to this category. They are what make it durable.

A freeze on compliant products while those rules are built would serve a different purpose. American regulatory history shows what happens when policy tries to slow a consumer shift that has already taken root. Trust erodes. Grey markets grow. Responsible operators bear the cost while large capital waits on the sidelines.

Policy can evolve alongside the market it governs. The demand already exists, and the products are already on shelves. The work ahead lies in writing rules that match the world consumers are living in, not trying to return to a world that has already moved on.

The Cooler Tells the Truth

Change rarely announces itself with fanfare. It shows up in small choices. A can in a cooler at the beach. A Friday night that ends without a penalty the next morning. A generation that views feeling well tomorrow as part of enjoying today. Social life did not shrink. It adjusted to match how people want to feel.

THC beverages did not surge because of hype. They earned their place through steady innovation, cultural fit, and timing. Established, deeply entrenched interests asked for a pause. Consumers kept buying. The question in front of policymakers now is straightforward. Write sensible rules for a market that already exists, or try to recreate a version of the world people have already left behind.

Markets move. Policy earns trust when it recognizes where people already are and responds with clarity and pace, not postponement.

Sources, Resources, and Suggested Reading:

“Big Alcohol Prepares to Fight Back as Cannabis Drinks Steal Sales,” Reuters, July 23, 2025.

“THC-Infused Beverage Sales Topped $1 Billion in 2024,” MJBizDaily, 2025.

“Three in Four Young Adults Say They Use Marijuana as an Alcohol Alternative at Least Once a Week,” CannabisMD Telemed, 2025.

“More Young Adults Are Opting for Cannabis Drinks Over Alcohol at After-Work Happy Hours,” Marijuana Moment, November 2025.

“Congressional Crackdown on Hemp Loophole: Significant Changes Loom for the Hemp Industry,” King & Spalding LLP, 2025.

“Ripple Effects: Texas Hemp, THC Beverages, and the National Farm Bill Frontier,” Forbes, September 8, 2025.

“A New Buzz: How Hemp-Derived THC Beverages Can Revitalize NY Craft Breweries and Cideries,” Evans Fox LLP, 2025.

“Hemp Beverages FAQ: Federal and State Laws Reshaping the THC Drink Market,” Vicente LLP, 2025.

“The Regulatory Chaos of Cannabis Drinks Retail,” SevenFifty Daily, 2025.

“Alcohol and Beverage Trends 2024,” Beverage Marketing Corporation, 2024.

“Alcohol Use: United States Age Groups and Demographic Characteristics,” National Institute on Alcohol Abuse and Alcoholism (NIAAA), 2024.

“THC Beverage Makers and Distributors: Top 5 Concerns for 2025,” Cannabis Law Now, January 2025.

“Hemp Production and the 2018 Farm Bill,” U.S. Food and Drug Administration, Congressional Testimony, July 25, 2019.

“2024 OCM Market Report,” New York Office of Cannabis Management, June 26, 2025.

“Cannabis Beverages Business Analysis Report,” Yahoo Finance, 2025.

“Alcohol Consumption and Purchasing Trends 2024,” Penn State Extension, 2024.

“Gallup Poll: U.S. Drinking Habits,” Gallup, 2025.